The leading U.S. platform for buying and selling major cryptocurrencies will likely go public in the future, its new president said.

"The most obvious path for Coinbase is for us to go public at some point," Asiff Hirji, the company's president and COO, said Thursday on CNBC's "Fast Money" in his first televised interview since taking the role on Dec. 1.

Hirji added that a public offering is "certainly in the interest of our investors," which include his former employer Andreessen Horowitz. Hirji was also previously the president and COO of online broker TD Ameritrade.

Coinbase says on its website it has raised $217 million from investors Union Square Ventures, the New York Stock Exchange and USAA. The startup is valued at at least $1.6 billion.

"I think we would be quite expensive for any exchange to look at" in terms of an acquisition, Hirji said Thursday.

Hirji said he could not comment on whether Coinbase would add support for other cryptocurrencies in the near future. "I think you should expect over time there will be more and more assets listed," he said.

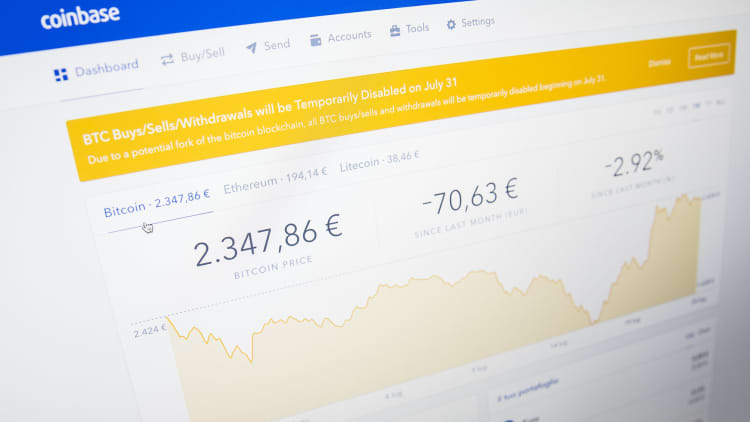

Coinbase is the leading U.S. platform for buying and selling bitcoin, ethereum and litecoin, and also operates an exchange for institutional investors called GDAX. However, currencies such as Ripple are not yet supported.

Digital currency bitcoin has surged 2,000 percent over the last 12 months to around $16,700, according to Coinbase data. The jump in interest has benefited San Francisco-based Coinbase, which was founded in 2012 and has grown rapidly in the last 18 months. The company had more than 13 million users at the end of November, up from less than 5 million a year ago, according to publicly available data. At least 75 job openings were listed on Coinbase's website Thursday.

The company also announced Tuesday that David Marcus, vice president of Facebook messaging products and former president of PayPal, will be joining the digital currency company's board.

But Coinbase has struggled to keep up with customer demand. The platform suspended ethereum buys and sells twice on Tuesday, and its GDAX exchange also reported "partially degraded service."